Understanding the basics and best practices of the Automated Clearing House (ACH) system

Automated Clearing House (ACH) is an electronic payment system that facilitates secure transfers between bank accounts and offers businesses a smooth alternative to traditional payment methods such as credit card, cash, or checks.

ACH payments are gaining significant traction in the decorated apparel industry. In fact, it was one of Printavo’s most requested features because ACH can be a cheaper alternative to credit cards for collecting payment on large orders.

At the end of 2022, Printavo launched embedded payments, which gives customers the option to collect payment through ACH. Printavo, too, allows you the option to offer ACH as a payment collection method from some or all of your customers.

However, if you decide to process ACH transactions, we want to make sure we’re providing you with a solid grasp of the basics as well as tips for best practices to safeguard against potential fraud.

In this blog post, we will cover:

- The steps and timeline of an ACH transaction

- How ACH returns work and why they might happen

- Best practices to prevent fraud when offering ACH transactions

The steps and timeline of an ACH transaction

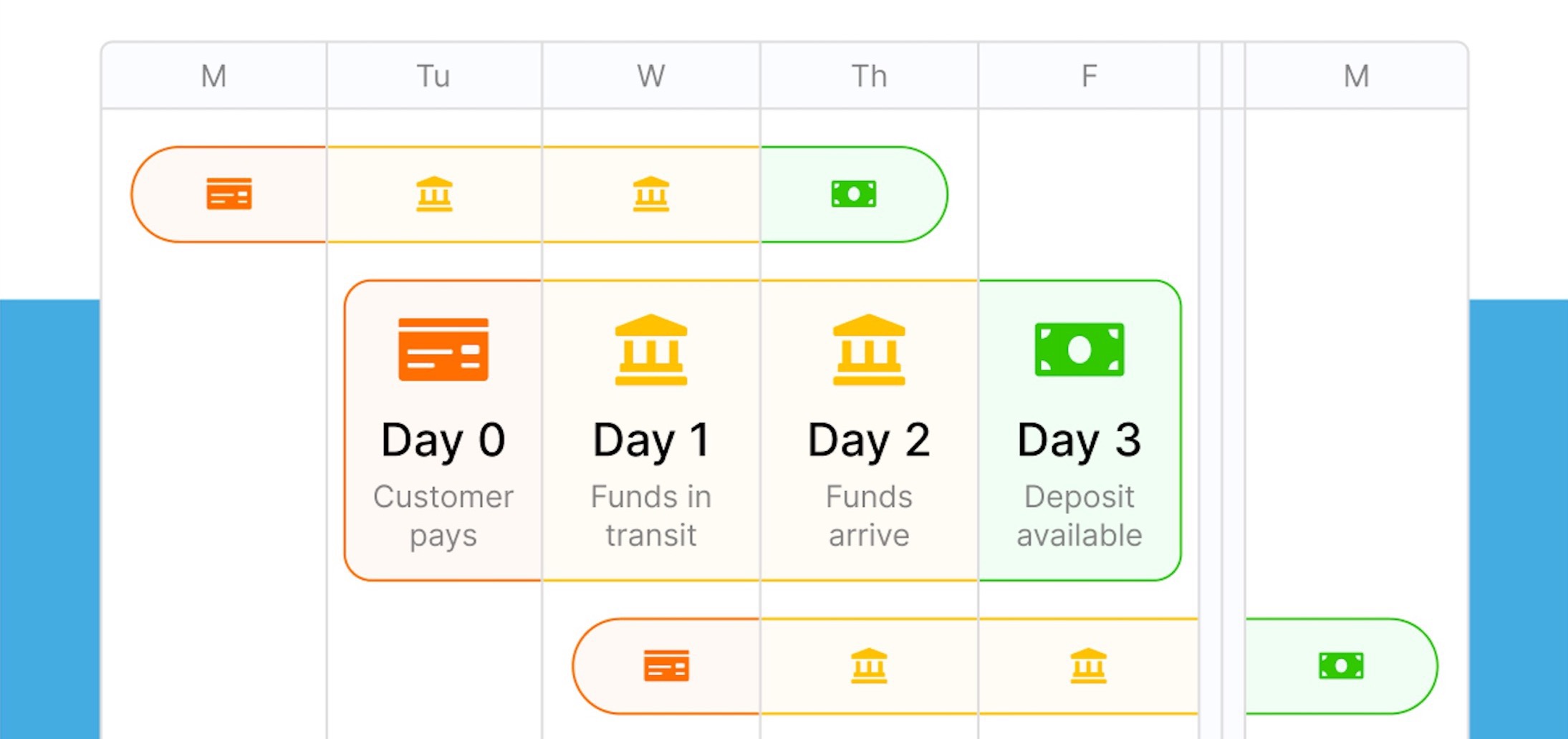

Here are the 4 steps of how an ACH transaction would work between your shop and your customer once you’ve manually made or automated a payment request:

- Initiation of Payment: When a customer selects “Pay by Bank Account” in Printavo and submits their payment they are initiating an ACH debit to their account.

- Customer Authorization: When a customer provides their bank account information, including the routing number and account number, securely, into Printavo (or whatever payment platform), that customer is authorizing the payment.

- Processing: The payment request is sent to the ACH network. The ACH network then processes the payments, sorting and batching them to the appropriate receiving banks (your purchaser’s bank).

- Settlement: Their bank processes the payment and settles it by sending a provisional credit to your account.

This entire process typically takes between 1 and 3 banking days.

How ACH returns work and why they might occur

A returned payment is commonly referred to as an ACH return. While ACH payments are generally reliable, transactions are occasionally returned or rejected.. This is usually because of insufficient funds, incorrect account information, or even closed accounts.

The ACH network has a structured process for handling returned transactions. Initiated by the purchaser’s bank, this process can take anywhere from 5 to 7 banking days to complete.

There are two primary types of ACH returns:

- Soft Return: A “soft” return occurs due to issues that can be rectified, such as insufficient funds.

- Hard Return: In contrast, a “hard” return is triggered by issues that cannot be corrected, such as a closed account.

Best practices to prevent fraud when offering ACH transactions

To ensure the smooth flow of ACH transactions and minimize the risk of fraud, shops should proactively adhere to several key best practices:

-

- Set clear agreements with Terms and Conditions: Establishing written agreements with customers is fundamental. These agreements should outline essential transaction details, including payment amounts, due dates, and any potential fees linked to late payments or returned transactions. In Printavo, you can set default terms and conditions to appear on all jobs under your Invoice Information settings.

Need help writing Terms and Conditions? Check out our free guide on terms and conditions. Free Download: Sample Terms and Conditions for Screen Printing Shops | How to Write Terms and Conditions

- Set clear agreements with Terms and Conditions: Establishing written agreements with customers is fundamental. These agreements should outline essential transaction details, including payment amounts, due dates, and any potential fees linked to late payments or returned transactions. In Printavo, you can set default terms and conditions to appear on all jobs under your Invoice Information settings.

- Get Customer Authorization: In order to initiate an ACH payment, you must first obtain the customer’s authorization. In Printavo, this is done by having the customer enter their own account details through the checkout flow.

- Customer Due Diligence: When customers make purchases, gather comprehensive information such as email addresses, phone numbers, and billing addresses. Sudden changes in behavior, such as unusually large orders or a shift in product preferences, could indicate potential fraud.

Learn more about common fraud tactics in our industry. - Only allow ACH transactions with certain customers: In Printavo, you can choose which of your customers have the ability to pay with ACH. If you’re not sure that you’d like to allow a specific customer to pay via ACH, then use Printavo’s settings to turn off ACH acceptance for that customer.

- Review Suspicious Orders: Implement a review process for unusual orders. This could involve manually verifying information before fulfilling the order.

Remember, if an order is too good to be true, it probably is. - Monitor and respond to failed ACH transactions: In cases where ACH transactions encounter issues (e.g., a hard or soft return), swift follow-up is vital to ensure you get paid for your work. Some shops even choose to delay fulfilling orders paid via ACH for 5-7 days after the deposit to reduce the chances of returns. (If you do take this approach, we recommend including this timeline in your Terms and Conditions to manage expectations.)

A Smooth Ride with ACH Payments

By getting the hang of ACH transactions and sticking to smart practices, shops can easily jump on board with this electronic payment method while keeping an eye out for any potential fraud hiccups.

In the ever-changing world of online transactions, businesses armed with the right know-how and practical steps can make the most of ACH payments, ensuring both security and happy customers.

Questions?

Email us at support@printavo.com and we’d be happy to help!

0 Comments