It looks a recession is on.

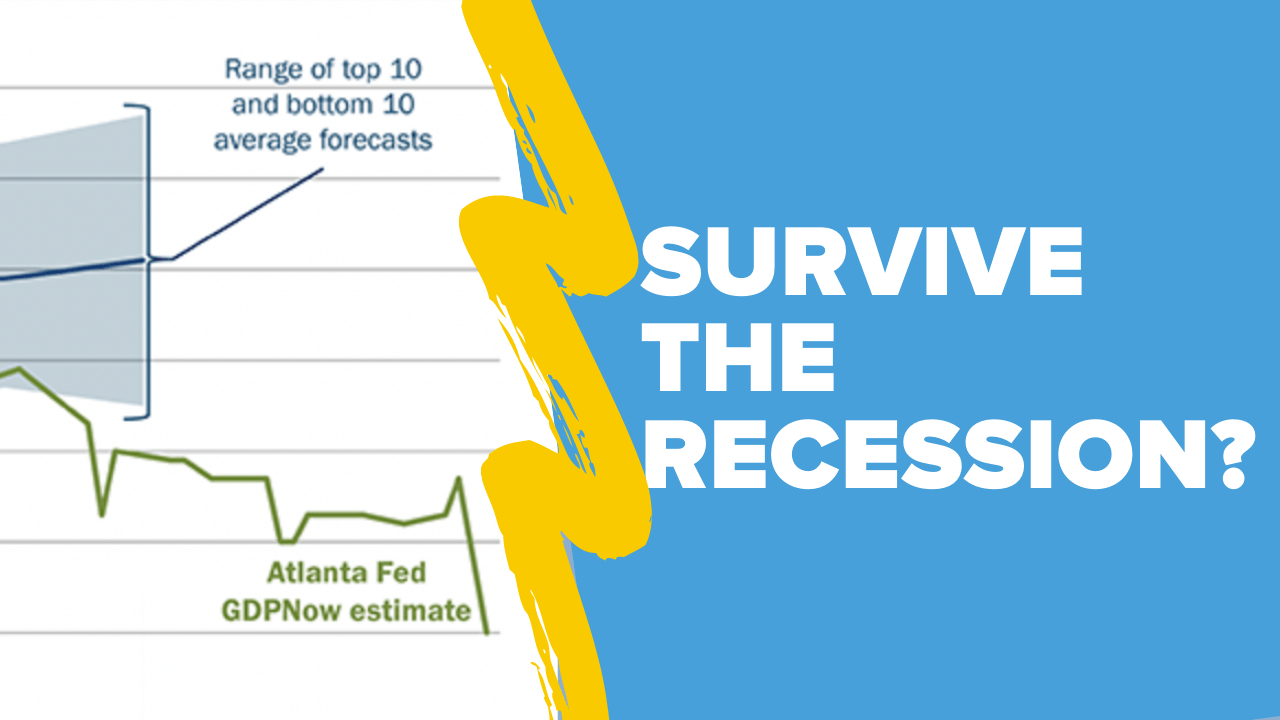

The Atlanta Fed’s GDPNow forecast is -1.0% for Q2 2022:*

Remember: a recession is technically defined as a decline in GDP for two consecutive quarters.

But whatever you do, don’t panic just because there are a few new lines on a Fed chart and GDP numbers have changed. GDP isn’t the be-all-end-all of economic metrics. In fact, it may not even be that good.

But something is happening in the economy and now is your chance to prepare.

We have some ideas for dealing with a recession. Read on.

*Uh, oops – literally as we went to publish this newsletter, the US Atlanta Fed revised their numbers to -2.1% GDP for Q2 2022. Yikes.

I’m going to be honest, whatever is happening in the economy right now is a little frightening. As I noted in the intro, the Atlanta Fed revised their Q2 GDP estimate down a lot. This happened in twelve hours, so things are moving quickly.

Adam Tooze points out that personal expenditures are below trend and consumer disposable income is at the lowest it’s been since the pandemic too.

So basically, the light is flashing: WARNING! Rocky road ahead!

Let’s share some ideas for how to stay in business, even if the ride gets bumpy.

Be the best

It’s cliche to quote Warren Buffett as financial advice. But it’s a cliche because it works.

Buffett was recently asked what to do to survive in an economic downturn with high inflation at the 2022 Berkshire Hathaway shareholders meeting. His advice is simple: be the best at something.

You can’t individually do much to fight recessions or inflation. But there is something you can do to secure your wellbeing: be exceptionally good.

“The best thing you can do is to be exceptionally good at something,” [Buffet said]. Mentioning professions like doctors and lawyers as examples, Buffett said that “[people] are going to give you some of what they produce in exchange for what you deliver.” – CNBC

This is great advice. But I have to add a caveat: there are a LOT of ways to be “exceptionally good at something” in the print industry.

Look at any successful print shop and you’ll notice right away that:

- No two shops have the same business model. There is always a huge degree of variance, even between shops that do fairly similar jobs.

- No two shops have the exact same niche. Shop A that serves softball teams in one part of the country looks very different than Shop B that serves baseball teams – even though they’re ostensibly the same niche.

- No two shops excel at exactly the same things. Some shops are excellent at customer-facing processes – they’re software wizards. Some are amazing at printing complicated jobs.

Shore up cash flow, get customers off net terms

A great client takes on 30-day net terms. They’re reliable: 4+ orders a month, each several thousand dollars. They keep coming back, but the shop sees that this client is slowly (but surely) accruing a big balance.

Is this a business risk you’re comfortable with?

There’s no right answer here. This is something that you have to decide: are net terms worth the risk?

After all, think about the structure of net terms.

What’s really going on here?

Your shop gives the customer a multi-thousand dollar loan with no interest.

Even better (or worse?), the customers that want the longest terms tend to be the biggest corporations!

Our advice? Get paid 100% upfront, every time. Yes, you can.

Carefully survey your fixed costs

Jersey Ink keeping an eye on it. From their Instagram.

If you’ve “let it rip” for the past two years and haven’t carefully controlled costs, you’re probably not alone. With inflation and shortages creating a dual pressure chamber of cost increases, shops simply haven’t had time to carefully budget or control costs.

Now is the time to begin carefully surveying and understanding all of your fixed costs. Think about:

- Insurance

- Leases

- Consumables

- Energy costs

- Subscriptions

One strategy is to write out all of these costs and rank them as “Essential,” “Nice To Have,” “Not Required.”

Essential costs are anything that would hamper business operations.

Nice To Have costs are things that optimize, improve, or otherwise make the quality of life higher at the shop.

Not Required costs are luxuries, experiments, and even just habits. Begin eliminating the “Not Required” costs first.

Consider equipment purchases carefully

While it’s great to expand your business, adding capacity can mean adding more monthly payments.

That doesn’t mean you should cancel purchasing that new press you’ve carefully planned for, or avoid upgrading your dryer even though it’s a bottleneck. Don’t skimp on the tools that can get your production capabilities beyond where they are now. But do plan carefully.

One strategy is to rank equipment into three categories:

- Bottlenecks: anything that prevents you from printing faster or more. The most common example is the dryer that’s simply too small or too slow to keep up with jobs, or even a computer to screen system to speed up screen making. Fixing this allows you to “do more with less.”

- Essentials: the tools and machines you need every day. You can’t get rid of them. You have to keep paying for these no matter what.

- Capacity expansion: things that you want to add that allow you to do more with more. Think a second press or a split belt dryer if your current dryer is big enough. Be careful here – this is where you can blow past your budget.

But we want to be wary of telling any business to “futureproof” their operations by burying their head in the sand and thinking that there’s no need to keep growing. This isn’t the case. But you may need to reconsider exactly how and when you make purchases for equipment.

And remember – buying used is always an option!

Avoid line extension and new services

New Coke – a classic example of line extension gone wrong.

In a recessionary environment, it’s incredibly tempting to do “line extension.” You already know what line extension is, even if you’ve never heard the term before.

Line extension is, in its simplest form, taking the brand name of a successful product and putting it onto a new product line.

What would this look like in a print shop?

Well, let’s say a shop is a very experienced screen printing operation. A recession hits, and the bulk of their high-volume orders start to evaporate.

So they say: hey, we’re getting a lot of quotes for small orders. Why don’t we dive into on-demand and start making money that way?

Seems smart, right? Chase the money!

Wrong! “Invariably, the leader in any category is the brand that is not line extended,” explain Ries & Trout in their classic The 22 Immutable Laws of Marketing.

The accumulated experience that the shop has is in screen printing. Yes, on-demand printing utilizes some of the same skills in the business. But it’s a very different game.

I like to think of line extensions like an oasis in the desert.

From far away, it looks great and makes a lot of sense. But the reality? It’s an illusion that will draw you further from where you want to go.

But maybe start a new business?

Okay, so line expansion is out.

In recessions, the number of new businesses created tends to fall. This is true for the last two recessions.

It makes sense, right? Why would you start a new business when the overall economy is in the can?

Well, there are two answers to this question.

The first answer is probably obvious. You start a business in a recession because there’s no business to go work for. You have to work for yourself. This is kind of the story of shops like Barrel Maker that sprung up during the last recession.

The second answer is a little less obvious. You’d start a business in a recession because there’s going to be a lot less competition and a lot more opportunity. During the boom of 2021, business creation rose astronomically. This meant everyone starting a new print business was competing with a dozen other entrepreneurs – all competing for the same limited set of customers, blank goods, resources, etc. In a recessionary environment, it’s like you have the whole football field to yourself.

So if you’re itching to start a new business, enter a new niche, or totally re-brand your shop – this might be the opportunity you’ve really wanted all along. Silver linings, right?

Build (or fortify) your emergency fund while you can

Logodaddy with a good reminder. Photo from their Instagram.

A business emergency fund is not just something that is “nice to have,” it’s essential.

Not every business has one. Everyone knows this.

What happens in recessions is, frankly, brutal. The businesses that can’t weather storms don’t. They are forced to liquidate equipment, lay off workers, cut production,

But if you have a healthy runway, you can offer certainty to your employees and yourself. I’d love to tell you that you should immediately work toward a 6 month runway – meaning that if you closed your doors today, you could keep paying all of your bills and employees just like they are for 6 months.

But I know that isn’t realistic for most print shops. The margins aren’t there. Even with a rock-solid Profit First system, a 6 month emergency fund is a big chunk of change.

So I won’t suggest that (though I’ll just say it’s very nice to have that kind of emergency fund and it’s how a lot of big companies plan to weather the recession).

Instead, I’ll simply say: if you don’t have some kind of emergency fund, now is the time to aggressively set aside cash for that rainy day. Start small, but start.

ID your riskiest customers

Trust Printshop has built loyalty. Photo from their Instagram.

Each customer you serve carries different levels of risk. Risk can take many forms for customers in the print game.

Here are a few examples:

- Too small to make it worthwhile. We’ve long touted the value of minimum order quantities (and advised you to set a minimum price to start an order). But small customers and jobs can soak your business unless you’re specifically set up to handle them. The time spent administering these jobs makes them almost worthless.

- Too big to lose. The other side of the coin: most shops have a customer that accounts for 20% or more of their total revenue. This is merely the Pareto principle in action. Knowing who your top customers are is essential. If they’re at risk, you’re at risk!

- Bad fit for your business. This is the third, and more difficult to define, category for risk. These customers may not align with your values (maybe you don’t want to print political shirts, for instance). They may not agree with how you run your business (and then leave a nasty review). Or they’re simply too demanding on your staff. However you identify this group, be wary!

It doesn’t intuitively make sense to pair back your customer base as you head into a recession.

But let’s put it another way. If you’re loyal to a business and spend a lot of money with them, you expect a high standard of service. If that business is stuck serving a dozen other customers, your service will likely suffer as a result.

In a recession, it’s business critical to know who your most important customers are and double-down on serving them to the highest standard possible.

Businesses are willing to fight for dollars during recessions – and loyalty pays off.

0 Comments