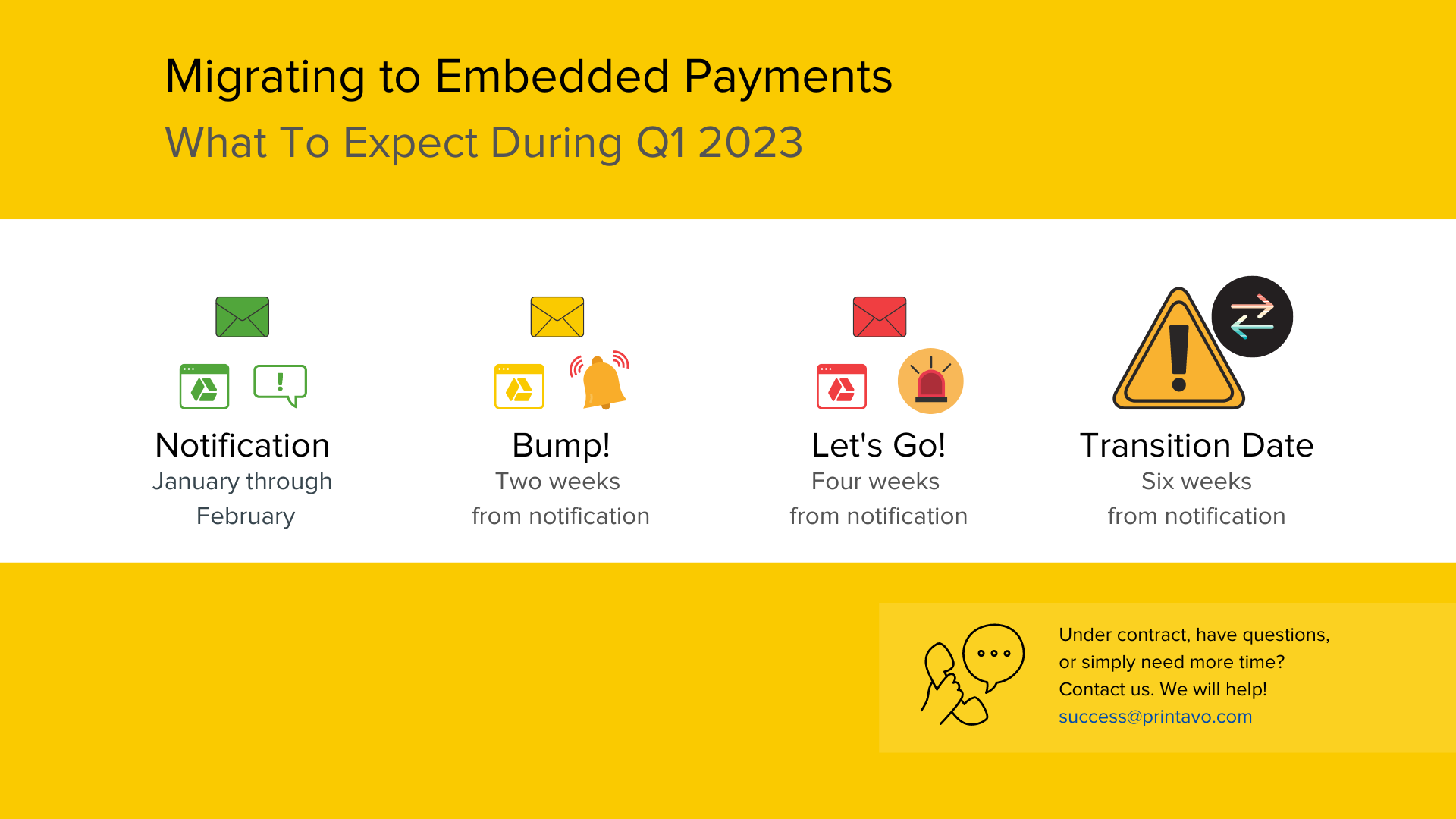

We have begun notifying shops that signed up prior to Q3 2022 and have not yet made the switch to Printavo’s embedded payments about when they will need to migrate to our embedded payment platform.

On April 3rd, 2023, payment automations linked to Stripe and/or Authorize.net will no longer be supported.

Our Success team is available to help you with strategies and resources to make it easy and profitable for you to migrate to embedded payments.

Email your Success Manager (or reach out directly to our Success team at success@printavo.com).

Watch from our live stream from December 7th

Join Jess Strainis from Printavo to see how embedded payments works, and give you some ideas for best practices for collecting payments. She demonstrates some ideas for implementing the new system and increasing collectability immediately (in other words: getting you paid faster).

This live stream also features a presentation and question-and-answer session from Renn Salo, Inktavo’s Head of Payments.

Shops will receive 6 (six) weeks to migrate, with migration waves ending between late February through late March.

- January-February 2023: Shops receive Migration Notification messages

- February through March 2023: 6 week embedded payments migration window opens, based on Migration Notification date.

- April 1, 2023: All feature development, bug fixes, support, and maintenance will occur only on the new embedded payment platform

- April 3, 2023: payment automations linked to Authorize.net and/or Stripe will no longer be supported. Customers that have completed sign up for embedded payments will be automatically switched to using embedded payments 4/3 if they haven’t already switched manually. Those that have not signed up and/or have not already received approval for their account will no longer be able to utilize their payment collection features and related automations through Printavo

- Throughout 2023: Our Success and Support teams are available to help you migrate

We’ve gathered the most common questions we’ve received about migration below.

- What’s it in for your shop?

- Why we’re offering embedded payments

- How do I know I can trust Printavo’s embedded payment solution?

- How long does it take to get paid?

- Is it only available in the US?

- Do I have to migrate now?

- What resources are available to help me migrate?

- What should I expect in January?

- What systems will continue to be supported in January and beyond?

- What if I have a capital loan?

- What if I am under contract with my provider?

- What happens if I want to opt-out of the migration?

Your shop’s success is our priority.

If you have specific obligations with other providers that prevent you from migrating within this timeframe, we are very happy to work with you. If you need additional time, reach out promptly to your Success Manager (or success@printavo.com). If you have other concerns, questions, or feedback, contact your Success Manager or email us at support@printavo.com.

What’s in it for your shop?

After application and approval, you’ll immediately get access to Printavo’s powerful new tools:

- Save money on fees with ACH payments, capped at $20 in processing fees

- Save time with reconciliation directly in Printavo

- Collect payment faster and more reliably with automations

- Better customer experience: easy, speedy checkout

- Train your staff quickly – just one platform to manage

- Control what payment methods are available with dollar thresholds (example: only accept ACH past a certain amount)

- Unlimited support (with a real live person)

- Even issue refunds directly from Printavo

There’s much more to come. Our dedicated payments team is building new features that make accepting and managing payment simpler and more profitable for shops. A sample of what’s to come:

- Statements (including the ability to have a purchaser pay multiple invoices at once)

- Partial refunds on Merch store orders

- Stored payment methods on file for repeat purchases

- Lending services

- Much, much more…

Ready to get started? Sign up now and get approved in days.

Why we’re offering embedded payments

ACH payment has been the most requested feature in Printavo for years. We’ve heard so many shops request all kinds of great payment features, like refunds and fees. We’ve heard time and time again that processing fees, slow deposits, and terrible customer service made third-party payment processing a huge pain.

We listened. But we couldn’t begin to provide the level of service necessary to create that product. Payments are right at the center of your business. It’s important to get it right.

Now, we have the resources and a dedicated team for payments that can finally deliver these urgently needed updates and improvements.

But to make those improvements, we had to make a choice.

Managing multiple integrations, requirements, and systems made feature development impossible to plan and manage. It became clear that we couldn’t provide you with the features you’re asking for because other processors made it nearly impossible.

We’re offering embedded payments to give shops what they need and have asked for to continue growing.

How do I know I can trust Printavo’s embedded payment solution?

Printavo’s embedded payments are powered by Payrix, an FIS company. FIS is the leading provider of technology for merchants, banks and capital markets firms globally.

Security and privacy are essential to payment processing. By partnering with Payrix, we are able to offer a variety of industry-standard best practices to securely processing payments.

Our embedded payments solution protects you and your customers: all supplied credit card information is transmitted via Transport Layer Security (TLS), which is the most up-to-date and secure version of Secure Sockets Layer (SSL) technology.

We do not store any credit card data. Like any payment processor, all of your data is encrypted to ensure compliance with data protection regulations (such as the Payment Card Industry Data Security Standard, also known as PCI DSS).

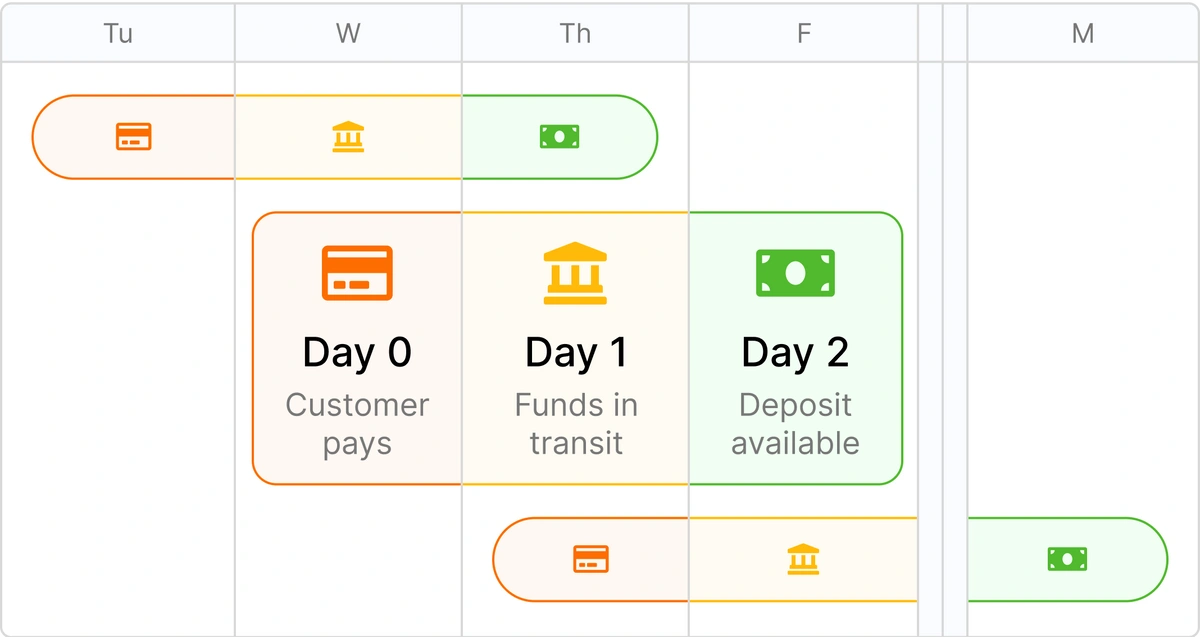

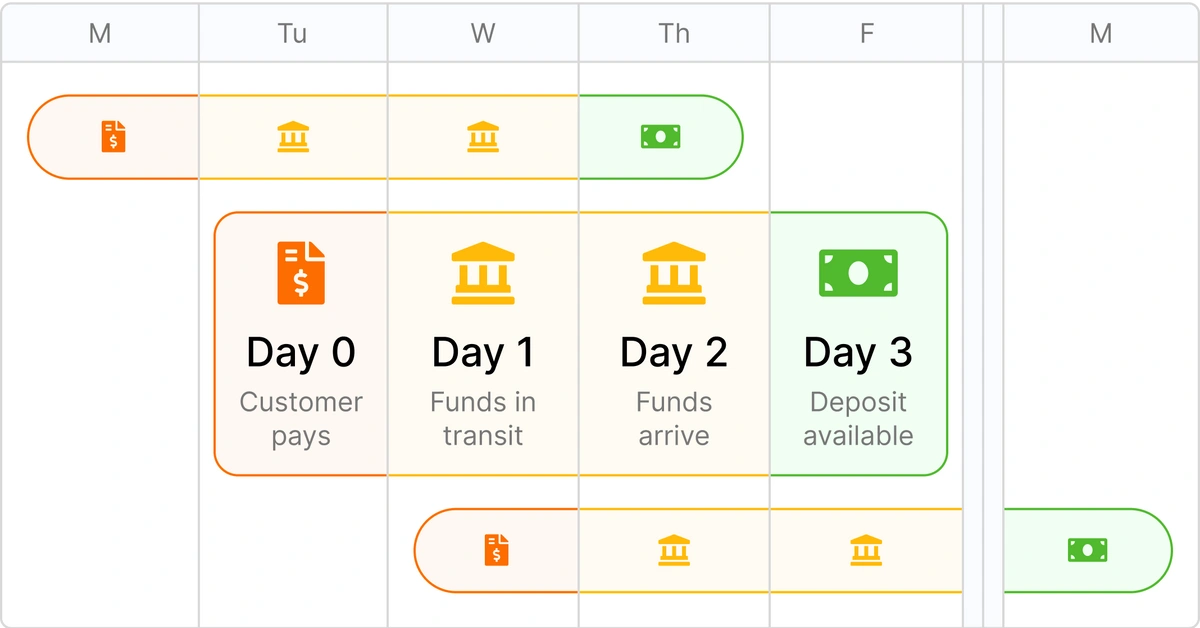

How long does it take to get deposits / get paid?

Deposits may include card and eCheck activity.

Cards are settled and deposited in 2 to 3 banking days from the date of the transaction.

eChecks are settled and deposited in 5-6 banking days from the date of the transaction.

Please note: transactions made after 9:30 p.m. EST are considered the following day.

By default, any fees that are due for that day are automatically netted from the deposit to your account. These fees may include exception items from a previous day’s activities.

Are embedded payments only available in the US?

Yes. Embedded payments are currently available to US-based shops only. Due to the differences in rules, regulations, underwriting requirements, and integration requirements, we do not currently offer embedded payments to international customers.

We are actively researching international payments. We plan to begin by supporting Canadian shops first.

We will continue to support the existing payment options for international shops. We’re committed to providing a robust solution no matter where your shop is located.

Do I have to migrate right now?

No! You do not have to migrate today.

To avoid disruptions in your ability to utilize payment automations please sign up before April 3rd, 2023.

Once you’ve signed up you can switch anytime by navigating to My Account > Accept Payments and selecting Payments as your Processor.

As of 4/3 any customer that has signed up but not already updated their Processor will be automatically updated to Payments to avoid disruptions in your ability to utilize payment automations.

We will give you at least 6 (six) weeks to make the migration and transition to embedded payments on Printavo. If you need more time or have other obligations, you will be able to work with your Success Manager (available at success@printavo.com) for a solution! We’re here to help.

What resources are available to help me migrate?

We have multiple resources available to help you migrate to embedded payments.

- Setting up for Payments, Refunds, and Deposits in Printavo (with FAQ)

- Learn what you need to sign up and get started with embedded payments

- Payments, Refunds, and Deposits

- Learn the best practices and techniques once you’ve migrated

What should I expect in January?

Look for an email notification from us about the transition, containing more information and key details.

We will announce the transition in waves to ensure we can provide each and every shop with the assistance needed while making the switch.

If you need more time, or have other obligations – reach out! Your Success Manager (available at success@printavo.com) will work with you.

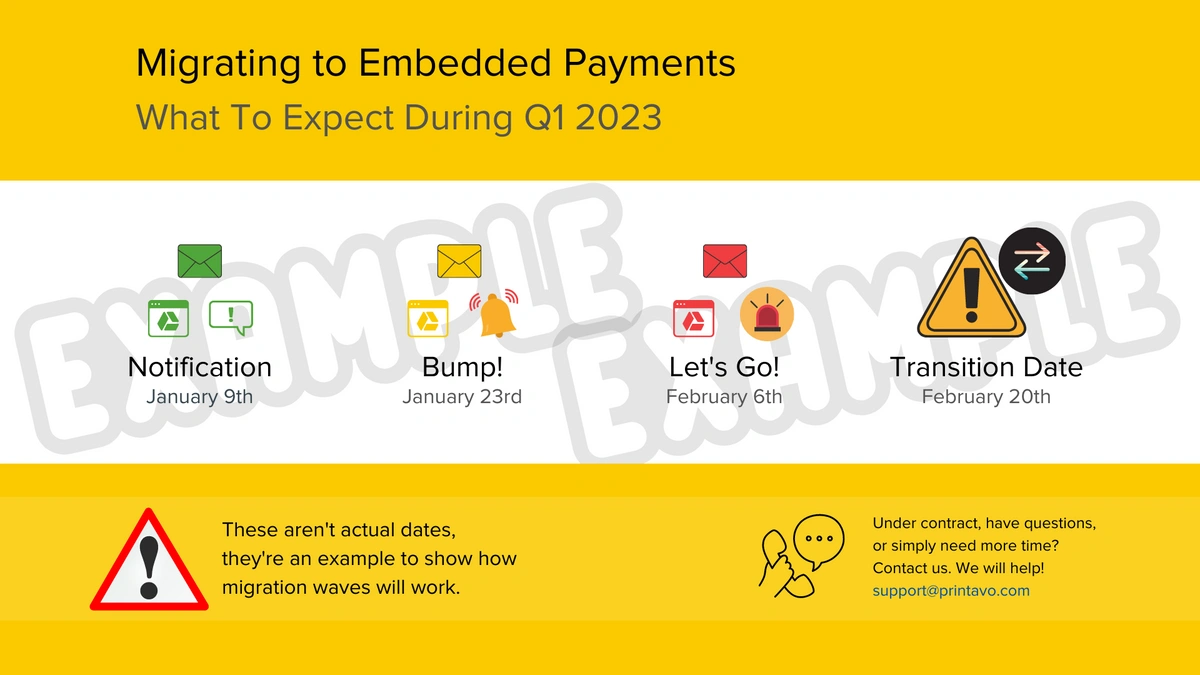

Here’s an example of how migration may proceed (these dates are not exact and are just an example):

Why can’t you tell me the dates?

As of April 3rd, 2023, payment automations linked to Stripe and/or Authorize.net will no longer be supported.

We want to inform you about our overall strategy and give you a simplified timeline to work off.

- January-February 2023: Shops receive Migration Notification messages

- February through March 2023: 6 week embedded payments migration window opens, based on Migration Notification date.

- April 1, 2023: All feature development, bug fixes, support, and maintenance will occur only on the new embedded payment platform.

- April 3, 2023: payment automations linked to Authorize.net and/or Stripe will no longer be supported. Customers that have completed sign up for embedded payments will be automatically switched to using this processor on 4/3 if they haven’t already switched manually. Those that have not signed up and/or have not already received approval for their account will no longer be able to utilize their payment automations through Printavo.

- Throughout 2023: Our Success and Support teams are available to help you migrate

We haven’t assigned waves yet because we want to allow you as much time to migrate independently before the migration waves.

What systems will continue to be supported at the end of Q1 2023?

If you’re already a Printavo shop today, we’ll continue to offer you PayPal and Square support beyond Q1 2023.

While we don’t have a card present solution available today, we do still support our Square integration and will continue to for the foreseeable future.

We will continue to support PayPal for shops that already use Printavo. Based on your feedback, we understand how important it is to retain and improve that functionality.

What if I have a capital loan, or am under contract with my provider?

We want to work with you because we understand how important payments are.

Please contact your Success Manager (or reach out to success@printavo.com) to ensure that there are no disruptions in your payment services at the end of Q1 2023.

Please be aware that future development (features, enhancements, bug fixes, maintenance, etc.) will only occur on the new embedded payment platform.

We are looking forward to providing capital loans in the near future.

What happens if I want to opt-out of the migration?

Printavo supports many shops that do not utilize our payment integrations!

You may collect payments outside of Printavo and record those payments manually within Printavo.

We will help you with migration, no matter your situation. Please reach out with your questions so we can clarify anything you’re uncertain about.

As always, we’re thankful to serve your shop.

0 Comments